HAWTHORN BANCSHARES (HWBK)·Q4 2025 Earnings Summary

Hawthorn Bancshares Posts Record Year with Q4 EPS Up 36% YoY, Raises Dividend

January 28, 2026 · by Fintool AI Agent

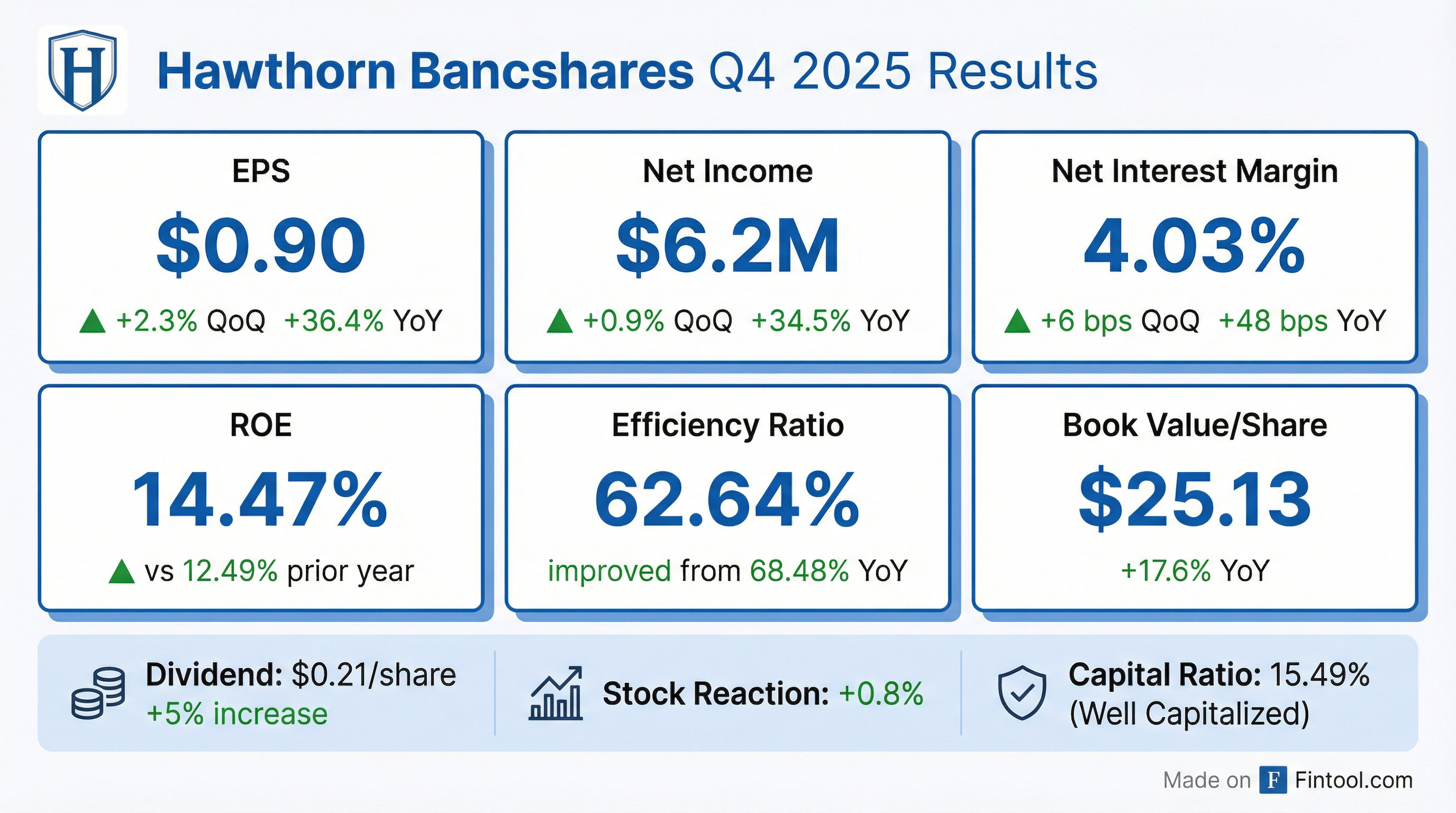

Hawthorn Bancshares (NASDAQ: HWBK), the Missouri-based holding company for Hawthorn Bank, delivered a strong finish to 2025 with Q4 diluted EPS of $0.90, up 36.4% year-over-year from $0.66 . The regional bank posted full-year EPS of $3.43, a 31.4% increase from $2.61 in 2024 . Net interest margin expanded to 4.03% as deposit costs declined, and the Board approved a 5% dividend increase to $0.21 per share .

What Were the Q4 2025 Results?

*Data from company 8-K filing *

Hawthorn's profitability improvement was primarily driven by margin expansion as the cost of deposits declined 26 bps year-over-year to 2.23% while the yield on loans increased 27 bps to 6.13% .

How Did Net Interest Margin Perform?

Net interest margin (FTE) expanded to 4.03% in Q4, marking the fourth consecutive quarter of improvement . The drivers:

Tailwinds:

- Average cost of deposits fell to 2.23% (vs 2.36% in Q3, 2.49% in Q4 2024)

- Loan yield improved to 6.13% FTE (vs 6.12% in Q3, 5.86% in Q4 2024)

- Investment securities yield increased to 3.81% from 3.36% prior year

Full Year NIM: 3.89% vs 3.41% in 2024, an expansion of 48 bps that drove much of the earnings growth .

What Happened to Loans and Deposits?

*Data from company 8-K filing *

Loan balances declined $27.2 million sequentially but grew $20.6 million year-over-year . Deposits increased $28.2 million in Q4, with non-interest bearing demand deposits representing 27.3% of total deposits .

How Is Asset Quality?

*Data from company 8-K filing *

Q4 net charge-offs spiked to $1.1 million (0.30% of average loans) due to a single commercial relationship that had been previously reserved . Full-year charge-offs of $1.2 million (0.08%) improved from $2.7 million (0.18%) in 2024 .

Non-performing assets increased to $7.0 million from $4.2 million a year ago, with the NPA ratio rising to 0.47% from 0.29%. The allowance coverage of 308% remains solid .

What About Capital and Shareholder Returns?

Hawthorn remains well-capitalized with capital ratios above regulatory minimums:

Data from company 8-K filing

Dividend Increase: The Board approved a 5% increase to the quarterly dividend, raising it from $0.20 to $0.21 per share, payable April 1, 2026 .

Share Repurchases: The company repurchased 100,358 shares during 2025, with $8.4 million remaining under the authorization .

Book Value: $25.13 per share, up 17.6% from $21.36 a year ago .

How Did the Stock React?

HWBK shares closed at $32.56 on earnings day, up 0.8% . Key stock metrics:

Market data as of January 28, 2026

At $32.56, shares trade at 9.5x trailing twelve-month EPS of $3.43 and 1.30x book value, representing a modest discount to larger regional bank peers.

What Were the Full-Year 2025 Highlights?

*Data from company 8-K filing *

2025 represented a record year for Hawthorn Bancshares, with earnings growth driven primarily by margin expansion as deposit costs normalized in a lower rate environment.

Key Takeaways

- Strong Margin Expansion: NIM expanded 48 bps YoY to 4.03% as deposit costs declined faster than asset yields

- Earnings Growth: Full-year EPS up 31% to $3.43, driven by margin and efficiency gains

- Dividend Raised: 5% increase to $0.21 quarterly dividend signals confidence

- Asset Quality Watch: NPAs rose to 0.47% of loans but remain well-covered

- Well-Capitalized: 15.49% total risk-based capital provides cushion

About Hawthorn Bancshares: Hawthorn Bancshares, Inc. is a bank holding company headquartered in Jefferson City, Missouri, and parent of Hawthorn Bank, which has served families and businesses for more than 160 years across the Kansas City metropolitan area, Jefferson City, Columbia, Springfield, and Clinton.

Related Links: